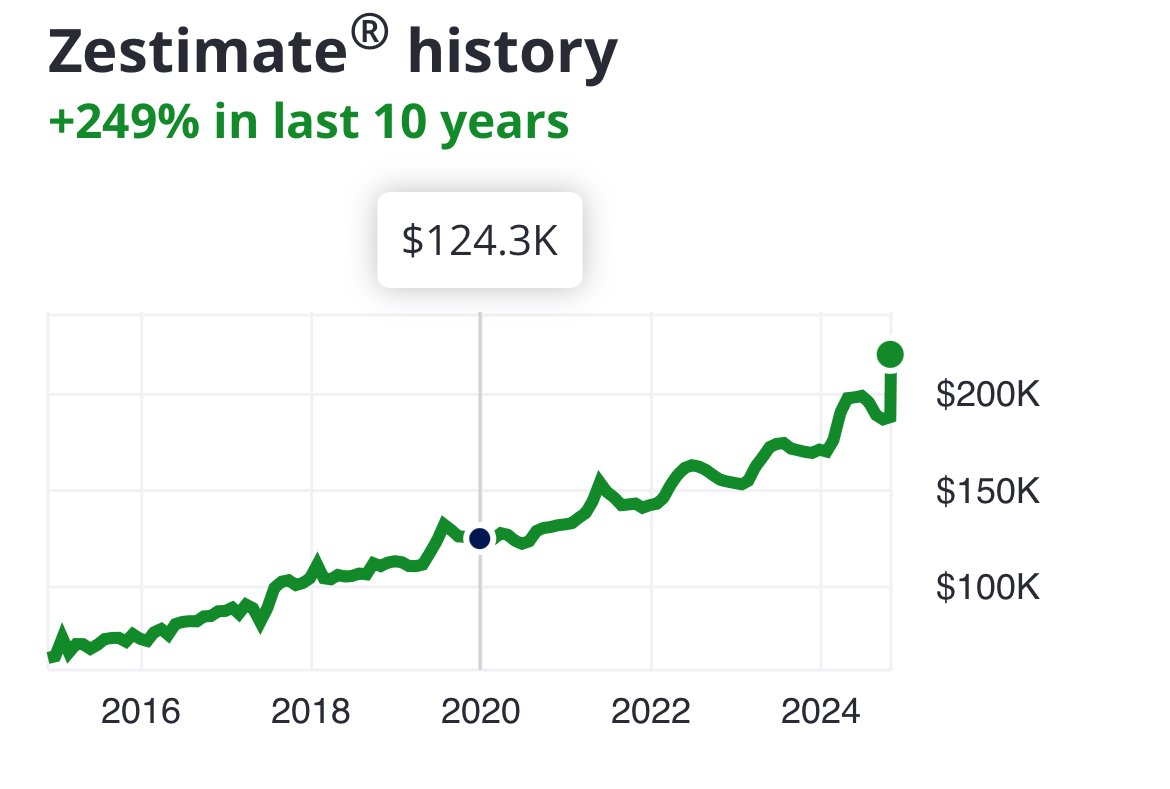

My salary didn’t change at all, but homes went up 82%. The money I saved for a down payment and my salary no longer are good enough for this home and many others. This ain’t even a “good” home either. It was a 200k meh average ok home before. Now it’s simply unaffordable

Not that this is “ok” but it’s why “buy whatever you can as soon as you can” is good advice. If you’d put whatever you had into a shitty condo four years ago, and kept saving at the same rate, you’d likely be in good position to trade up soon.

I see a lot of people I know end up in the same position because they’ve been waiting for either the exact right circumstances or for prices to “crash.” All the people i know who started with anything they could afford now have a huge amount of equity in nice homes. The difference is real and primarily about timing more than income or location.

I bought 5 years ago when it was still reasonable. I have a great rate on a great house that has increased by about 50% since I bought it.

I don’t want to, because this is just about the perfect size house for us in a great location, but I can’t really “trade up” as the interest rates are through the roof and everything is more expensive too.

If your circumstances change, you can make a lateral move and invest the net profit in an index fund.

I think you misunderstand. He didn’t have the financial wherewithal to acquire a home of any sort because a down payment was expected even of the shitty condo. He didn’t have the money then he doesn’t have the money now he’s on the same shitty treadmill that the rest of us in the permanent underclass are.

Time to eat the rich

No rich person is living in a 325k ranch house.

My man let me introduce you to globalism and people living in refugee camps in South Sudan.

$325K is more money than most of the people in the world for all of history would see in a lifetime.

Wake up to your riches.

Best hurry … Ozempic is destroying the caloric benefit

I like the utility feed hanging off the front of the house going straight through the roof and blocking them from installing the other fake shutter. I wonder what other construction horrors lurk inside.

This is everywhere. I’ve been looking for houses for 3 months in NW Ohio. 300k is the new 150k, and all the houses are beat to shit on the inside needing 50k just to make them passable inside because nobody takes care of them.

I wonder what proportion of it is also due to people fleeing 1 million + average house markets during the pandemic work from home wave. Not saying this about you, but it makes me think it’s funny how the common refrain of “Don’t like it? Just move” is often uttered by NIMBYs.

I think a big part of it is we’re on the other side of the peak of all houses going for 100k over asking regardless of condition. A number of houses have that grey vinyl flooring installed in a bunch of rooms that’s as cheap as it is ugly.

grey vinyl flooring

I hate that shit even more than I hated the fake wood paneling and shag carpet of the '70s. I bought a house last year that had the grey vinyl flooring in the living room and I’ve tried my hardest to fuck it up during the renovation so I have to replace it, but unfortunately it holds up to extreme abuse pretty well.

A former housemate did so much water damage with a portable A/C unit, that not even two months ago I had to rip up the whisper walk, and the original wooden flooring (house was built in the '30s) all the way down to the subfloor. Replacing the whisper walk would have been $3000 for just that room. We managed to find vinyl flooring that matched the rest of the flooring in the house and redid the floor for $1500.

My point is that you can get nice vinyl flooring, and it’s not terribly expensive to replace/ install.

Heh, according to the guy who sold me the house, he had to put the grey vinyl flooring in because of water damage from a portable AC unit.

That’s cheap as hell compared to California. And I work remote from anywhere I want. Thanks for the tip!

This is because venture capitalists are buying all the homes to rent

Said it before: no corporation except non-profits focusing on housing should own retail property.

So occasionally I look out of curiosity and the reason is pretty plain.

I look for houses for sale in a suburban area as public listings, and there’s like 1 within a few square miles of the area.

I switch over to renting, and there’s like 12 houses just like the one for sale available, all owned by companies. I also know a coule that aren’t listed that have no tenants, but are still owned by one of those companies. You can tell because those yards are now waist deep grasses (in an area where HOA throws a hissy fit if your yard looks just a smidge unkempt).

Don’t know why the companies find it more profitable to buy houses people aren’t looking to actually move into, at least at the rent they are willing to accept. If I fully understood why, it might just piss me off more. Like maybe the houses work better as a loan basis than other assets, so even empty and unused they are valuable as some sort of financial trick.

My understanding is that these companies are investment companies that need stable assets for their billions of dollars portfolios and they actively look to keep buying property as a stable form of appreciating asset. They have so much money that needs to find some way to make more money for their investors.

Don’t know why the companies find it more profitable to buy houses people aren’t looking to actually move into, at least at the rent they are willing to accept. If I fully understood why, it might just piss me off more. Like maybe the houses work better as a loan basis than other assets, so even empty and unused they are valuable as some sort of financial trick.

That’s one thing, but housing has been a low-risk investment for a long, long time. If they bought the house OP posted in 2020 and sold it in 2024 they would have almost doubled their money even without renting it out.

Also here in Europe this is the type of construction we use for a garden shed, not a house.

Even when we do modern timber frame, it’s generally still brick or block at the bottom. How long do these houses last in the US? I imagine a lot of the continent is pretty humid

Timber frames are sheathed in treated plywood and then wrapped in siding. Rain doesn’t reach the wood of a barely-maintained house, exterior humidity won’t do damage in any hurry, and wood is rarely making ground contact. These houses last at least a hundred years given that this style is approaching 100 years. It’s usually storm damage through the roof that causes the rotted wood you’re imagining, not normal wear and tear.

It’s a good thing you aren’t a building engineer.

My parents’ timber house is from the 1780s and is still solid. So, 240 years at least, give or take. I’m aware of plenty of timber houses from the 1600s that are still standing and functional as well.

Is a timber frame house from back then the same as one built post 1950 though? Some Q’s:

- Have materials/practices decreased in quality?

- Has there been a shift from a sense of pride in craft and duty to build well towards cutting corners and saving $?

- Has the density and properties of wood changed as we use smaller trees grown more quickly in monocultures compared to old-growth harvested lumber of pre 1900s?

When wood is properly sealed up in walls, it lasts a very long time. We don’t really have buildings on an old world timescale, but we do still have colonial wood frame buildings.

In California at least, houses made with a wooden frame are usually on top of concrete (either a concrete slab under the whole house, or a concrete perimeter under the exterior walls), and the frame is bolted into the concrete along the entire perimeter.

Older homes often aren’t bolted into the concrete, but it’s common to retrofit this to improve earthquake resistance. Without the bolting, the house can move around during an earthquake. The government here has a program (Earthquake Brace and Bolt) where they cover part of the cost of doing this work.

Masonry (houses made of bricks, stone, etc) are much less common here, since they perform much worse in earthquakes.

👍 in Europe earthquakes luckily are less of a concern, so we care more about longevity (you’ll find many places where pretty much every house is well over a hundred years old (the oldest one in my village is about 900 years old)) and good isolation (to keep the heat inside in winter and outside in summer so we can heat less / don’t have to use air conditioning on our way to net zero)

Yep, that’s on track! My house has almost tripled in price since I bought it 12 years ago. Denver metro. No way I could afford it if I had to buy it today.

A 1200 sqft bungalow near me just sold for 1 million Canadian rubles

And in the past I would ask “Toronto or Vancouver?” But I know that that could be in any city these days.

Not Vancouver. Nothing that size would go less than 2 million until you hit Coquitlam. MAYBE.

Yeah, we are boned all over the nation.

For fun here are some places you can buy for $1 million https://www.realtor.ca/real-estate/27507233/161-moyle-drive-yellowknife

https://www.realtor.ca/real-estate/27587880/7077-quinpool-road-halifax-halifax

https://www.realtor.ca/real-estate/27532186/1132-osler-street-saskatoon-varsity-view

Yeah. I’m pretty much resigned to living in our rental until we get renovicted. No kids, double income, a lot of savings… but the mortgage payments would be way more than it’s worth to have a minor upgrade. Strata payments alone are often more than our rent!

Condo/HOA/Strata fees are a big way people are kept out of owning their own place. Its crazy that almost every place even remotely affordable is part of one.

I get the need for them, to pay for shared building services. Strata fees pay for exercise rooms, pools, grounds maintenance, whatever. I 100% am behind them, as long as the Strata council is responsive to needs and not corrupted, but there’s the rub.

I’d generally be happier with few services and low strata fees tho.

Or not having any but fix your own shit. I like the idea of smaller houses and yards but not if that comes with shared maintenance fees.

The costs for some of these things is silly and since most people don’t volunteer to be on those boards they don’t even get to see how their fees are spent.

This won’t change as long as property ownership and property renting is unified. There’s just to much of a business incentive from renting, even if it takes decades to make it back. Worst that can happen is that it can sell it back to a market that criminalizes homelessness instead of treating it or its causes.

Keep in mind that inflation has risen over 30% in just the last 4 years, which explains at least part of the rise in prices. I wouldn’t be surprised if inflation is even higher in certain areas of the country. I’d also not be surprised if Georgia is getting a lot of natural disaster refugees from places like Florida.

The other part i don’t see anyone mentioning is that this was all projected as a result of millennial generation, the largest % of population by generation comparison, came into the age of buying homes. Creating a sharp spike in demand over supply.

It’s the same in Kansas City. I just checked a random house in my city and it’s up almost $100k in 4 years.

3bd, 1bath 976 sqft

You just need to stop watching Netflix and buying avocado toast.

At least that’s what old people say anyway.

Can confirme. I stopped drinking Starbucks and now I own a 50 acre plot with a 6 bedroom house on it. If only I would have listened to their Facebook comments sooner, I could have afforded that private jet too. Edit: Apparently sarcasm is lost on a few. So for explicitness - /s

With the Star bucks prices you might as well by a house. Damn they are expensive. People spend like $10 on coffee

I honestly just started going to my own local coffee joint. What used to be expensive for something like a cappuccino (like 7 bucks) is now cheaper than starbucks. Plus I help a small business.

Assuming you spend $10 on avocado toast every day, as well as $75 on eating out for every meal, $20 for Starbucks, and ALSO assuming you have $150 worth of monthly subscriptions:

It will take you 25 years to save one million dollars. That’s assuming you never get sick, never lose a job, never need to buy a car or have major repairs, or basically any kind of surprise expense or setback that could wipe out savings.

To be the richest person on earth, you would need to save that money every year for over 6 MILLION YEARS

Not to devalue your point, but if you truly were spending (10 + 3*75 + 20)*30 + 150 per month (so a total of 7800 USD) and you invest it in an index fund getting back 5%, you’ll have your million in 10 years. 8 years at 10% which is the long-term growth rate of DJIA and S&P 500.

You’ll still never be the richest person in the world, but if you truly were burning away that much money, you could make decent dough just from investing it passively. In 30 years you’d have like 15 million, more than enough to retire.

Now the only real problem is that nearly nobody is actually burning that much cash and the “stop eating avocado toast” suggestions are indeed stupid af.

A lot of boomers are going to die in the next ten years or so. That is the biggest age demographic in the u.s. the population is going to shrink by a lot. That’s why there’s a push to make people have more kids, because otherwise workers and consumers have a lot more power.

Private equity is already gobbling up the houses. Boomers are cashing in to finance extravagant retirement. Those who are not, are leaving it to their children who will then sell to private equity groups.

Eventually supply will catch up with demand which will supress rent (if we do something about the price fixing) and it will no longer be a viable investment. They’re probably losing a lot to management costs and capital expenses already.

Eventually supply will catch up with demand

Not if NIMBYs have their way. We have a MASSIVE supply problem already, and it’s getting worse.

Single-family rental is also a huge thing now.

I work in municipal development, and since 2021, 100% of single-family subdivision developments that have approached the city have been for rental-only neighborhoods.

And they want to put all the homes on a single shared commercial water meter on a single piece of property instead of extending public lines, so they can’t even be converted later without massive infrastructure projects and replatting.

if we do something about the price fixing

Narrator voice: they didnt

Where I am it’s more profitable to let it sit empty and make a Tax write of than lowering the asking rent.

Not exactly a good business strategy. You can deduct the taxes, insurance, management costs, but you have to amoratize depreciation of the building over 28 years. Not to mention that an empty house is going to start developing problems fairly quickly.